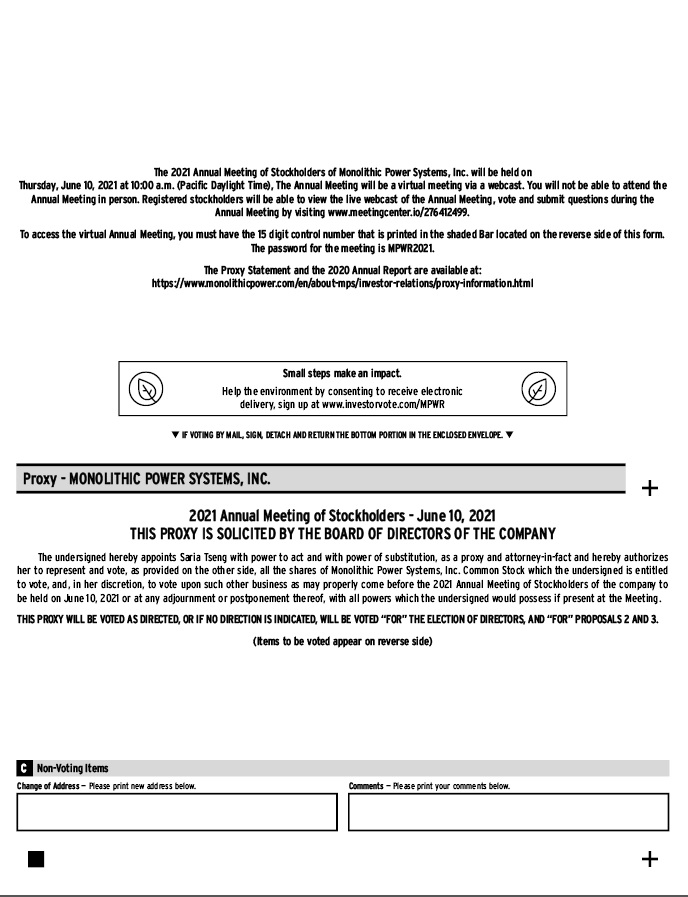

| Page General This Proxy Statement is being furnished to holders of common stock, par value $0.001 per share (the “Common Stock”), of Monolithic Power Systems, Inc., a Delaware corporation (the “Company” or “MPS”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, June 13, 201910, 2021 at 10:00 a.m., Pacific Daylight Time, and at any adjournment or postponement thereof for the purpose of considering and acting upon the matters set forth herein. TheThis year’s Annual Meeting will be held at our principal executive office located at 4040 Lake Washington Boulevard NE, Suite 201, Kirkland, Washington 98033. The telephone number at that location is (425) 296-9956.a virtual meeting. You will not be able to attend the meeting in person. Please follow the instructions carefully on how to access and attend the virtual meeting in the “Annual Meeting Attendance” section below.

Internet Availability of Proxy Materials Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials (the “Notice”) to certain of our stockholders of record, and upon request, we will send a paperprinted copy of the proxy materials and proxy card to other stockholders of record.card. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. Stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet at www.monolithicpower.com, and to mail the notice,Notice or to mail the Proxy Statement andother proxy card,materials, as applicable, on or about May 3, 2019April 30, 2021 to all stockholders of record at the close of business on April 16, 201919, 2021 (the “Record Date”). Record Date; Outstanding Shares Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof. These stockholders are entitled to cast one vote for each share of Common Stock held as of the Record Date on all matters properly submitted for the vote of stockholders at the Annual Meeting. On the Record Date, 43,036,45045,737,000 shares of Common Stock were issued and outstanding. No shares of our Preferred Stock were issued and outstanding. For information regarding security ownership by management, directors, and beneficial owners of more than 5% of the Common Stock, see the section ““Security Ownership of Certain Beneficial Owners and Management.” Procedure for Submitting Stockholder Proposals Requirements for stockholder proposals to be considered for inclusion in our proxy materials. Proposals of stockholders which are to be presented by such stockholders at our 20202022 annual meeting of stockholders must meet the stockholder proposal requirements contained in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and must be received by us no later than January 3, 2020December 31, 2021 in order that they may be included in the proxy statement and form of proxy relating to that meeting. Such stockholder proposals should be submitted to Monolithic Power Systems, Inc., 40405808 Lake Washington Boulevard NE, Suite 201, Kirkland, Washington 98033, Attention: Corporate Secretary. No such stockholder proposals were received by us prior to the deadline for this year’s Annual Meeting. Requirements for stockholder proposals to be brought before an annual meeting but not included in our proxy materials. If a stockholder wishes to present a proposal at our 20202022 annual meeting of stockholders, and the proposal is not intended to be included in our proxy statement relating to that meeting, the stockholder must give advance notice to us prior to the deadline for such meeting as determined in accordance with our Amended and Restated Bylaws (the “Bylaws”) (which are attached as Exhibit 3.4 to our Form S-1/A Registration Statement filed with the SEC on November 15, 2004). Under our Bylaws, in order to be deemed properly presented, notice of proposed business must be delivered to or mailed and received by our Corporate Secretary at our principal executive office not fewer than 90 or more than 120 calendar days before the one-year anniversary of the date on which we first mailed the proxy statement to stockholders in connection with the previous year’s annual meeting of stockholders (the “Notice Period”). As a result, the Notice Period for our 20202022 annual meeting will begin on January 3, 2020December 31, 2021 and end on February 3, 2020.January 30, 2022. However, in the event the date of the 20202022 annual meeting will be changed by more than 30 days from the date of this year’s meeting, notice by the stockholder to be timely must be so received not later than the close of business on the later of: (1) 90 calendar days in advance of the 20202022 annual meeting and (2) 10 calendar days following the date on which public announcement of the date of the 20202022 annual meeting is first made. A stockholder’s notice to our Corporate Secretary shall set forth as to each matter the stockholder proposes to bring before the 20202022 annual meeting: (a) a brief description of the business desired to be brought before the 20202022 annual meeting and the reasons for conducting such business at the 20202022 annual meeting, (b) the name and address, as they appear on our books, of the stockholder proposing such business, (c) the class and number of shares of Common Stock that are beneficially owned by the stockholder, (d) any material interest of the stockholder in such business, and (e) any other information that is required to be provided by the stockholder pursuant to Regulation 14A of the 1934 Act, in his or her capacity as a proponent to a stockholder proposal. If a stockholder gives notice of such a proposal after the Notice Period, the stockholder will not be permitted to present the proposal to the stockholders for a vote at the 20202022 annual meeting. Annual Meeting Attendance Attendance: After careful consideration, in light of the on-going developments related to the COVID-19 pandemic and governmental decrees that in-person gatherings be restricted, and in the best interests of public health and the health and safety of our stockholders, the Board and employees, the Annual Meeting will be held solely by remote communication. You will not be able to attend the meeting in person. Stockholders as of the close of business on the Record Date who duly registered to attend the Annual Meeting will be able to listen to the webcast, vote their shares and submit questions during the virtual meeting. Information to access the Annual Meeting is as follows: Web address: | www.meetingcenter.io/276412499 | Username: | Your 15-digit control number | Meeting password: | MPWR2021 |

We encourage you to access the Annual Meeting ten minutes prior to the start time for the check-in. Registration Process: Stockholders of record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered, with respect to those shares, the stockholder of record. As a stockholder of record, you are already registered for the virtual meeting and will be able to listen to the webcast, vote and submit questions during the meeting. Questions pertinent to meeting matters and that are submitted in accordance with our rules of conduct for the Annual Meeting will be answered during the meeting, subject to applicable time constraints. Beneficial owners. If you hold your shares through a broker, bank, trust or other nominee, you must register in advance in order to vote and submit questions during the virtual meeting. Alternatively, you may join the meeting as a guest and listen to the webcast without advance registration. As a guest, you will not be able to vote or submit questions during the meeting. To register in advance, you must obtain a legal proxy from the broker, bank, trust or other nominee that holds your shares giving you the right to vote the shares. You must submit proof of the legal proxy reflecting our holdings, along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 2:00 p.m., Pacific Time, on June 4, 2021. You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration can be made in the following methods: By e-mail: | legalproxy@computershare.com | By mail: | Computershare | | Monolithic Power Systems Legal Proxy | | P.O. Box 43001 | | Providence, RI 02940-3001 |

Voting Voting prior to the Annual Meeting. If you are the record holder of your stock, you have three options for submitting your votes prior to the Annual Meeting: | | ● | by following the instructions for Internet voting printed on the Notice or your proxy card; |

| | ● | by using the telephone number printed on your proxy card; or |

| | ● | by completing the enclosed proxy card, signing and dating it and mailing it in the enclosed postage-prepaid envelope. |

If you have Internet access, we encourage you to record your vote on the Internet. It is convenient, and it saves us significant postage and processing costs. In addition, when voting over the Internet or by telephone prior to the meeting date, your vote is recorded immediately, and there is no risk that postal delays will cause your vote to arrive late, and therefore not be counted. All shares entitled to vote and represented by properly executed proxy cards or properly granted proxies submitted electronically over the Internet or telephone received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions provided. If no instructions are indicated, the shares represented by that proxy will be voted as recommended by the Board. If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxies and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any matters other than the proposals described herein will be raised at the Annual Meeting. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, you will receive a notice from your broker, bank, trust or other nominee that includes instructions on how to vote your shares. Your broker, bank, trust or other nominee will allow you to deliver your voting instructions over the Internet and may also permit you to submit your voting instructions by telephone. YOUR VOTE IS IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting. Voting by attendingAttending the Annual Meeting. A stockholderThis year’s Annual Meeting will be a virtual meeting. Stockholders of record may also vote his or her shares in person atand beneficial owners as of the Annual Meeting. A stockholder planningclose of business on the Record Date who duly registered to attend the Annual Meeting should bring proof of identification for entrancewill be able to listen to the Annual Meeting. If a stockholder of record attendswebcast and vote their shares during the virtual meeting. Please follow the instructions carefully on how to access and attend the virtual meeting, and vote in the “Annual Meeting he or she may also submit his or her vote in person, and anyAttendance” section of this Proxy Statement. Any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the Annual Meeting. If you wish to attend the Annual Meeting in person but you hold your shares through a broker, bank, trust or other nominee, you must bring proof of your ownership to the Annual Meeting. For example, you could bring an account statement showing that you beneficially owned shares of our Common Stock as of the Record Date as acceptable proof of ownership. You must also contact your broker, bank, trust or other nominee, and follow its instructions in order to vote your shares at the Annual Meeting. You may not vote your shares at the Annual Meeting unless you have first followed the procedures outlined by your broker, bank, trust or other nominee. Changing vote; revocabilityRevocability of proxy. Any proxy given by a stockholder of record pursuant to this solicitation may be revoked by the person giving it at any time before it is voted at the Annual Meeting. Proxies submitted by stockholders of record may be revoked by: | | ● | filing a written notice of revocation bearing a later date than the previously submitted proxy which is received by our Corporate Secretary at or before the taking of the vote at the Annual Meeting; |

| | ● | duly executing a later dated proxy relating to the same shares and delivering it to our Corporate Secretary at or before the taking of the vote at the Annual Meeting; |

| | ● | submitting another proxy by telephone or via the Internet (your latest telephone or Internet voting instructions are followed); or |

| | ● | attending and voting at the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a previously submitted proxy). |

Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or should be sent so as to be delivered to Monolithic Power Systems, Inc., 40405808 Lake Washington Boulevard NE, Suite 201, Kirkland, Washington 98033, Attention: Corporate Secretary, prior to the date of the Annual Meeting. If you hold your shares through a broker, bank, trust or other nominee, you may change your vote by submitting new voting instructions to your broker, bank, trust or other nominee. 2

TableNo Right of Contents

Neither Delaware law nor our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) provide for appraisal or other similar rights for dissenting stockholders in connection with any of the proposals to be voted upon at the Annual Meeting. Accordingly, our stockholders will have no right to dissent and obtain payment for their shares. Expenses of Solicitation We will bear all expenses of this solicitation, including the cost of preparing and mailing this solicitation material. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our directors, officers and employees may also solicit proxies in person or by telephone, letter, e-mail or other means of communication. Such directors, officers and employees will not be additionally compensated, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. We may engage the services of a professional proxy solicitation firm to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. If we hire a professional proxy solicitation firm, we expect our costs for such services would be approximately $10,000. Quorum; Required Votes; Abstentions; Broker Non-Votes Holders of a majority of the outstanding shares entitled to vote must be present at the Annual Meeting in order to have the required quorum for the transaction of business. Stockholders are counted as present at the meetingAnnual Meeting if they: (1) are present in personduly registered to attend and vote their shares at the Annual Meeting, or (2) have properly submitted a proxy card by mail or voted by telephone or by using the Internet. If the shares present at the Annual Meeting do not constitute the required quorum, the Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum. The required votes to approve the proposals to be considered at this Annual Meeting are as follows: | | ● | The affirmative vote of a plurality of the votes duly cast is required for the election of directors. As further described in Proposal One below, any nominee for director who receives a greater number of votes “Withheld” from his or her election than votes “For” his or her election will promptly tender his or her resignation to the Board following certification of the election results. |

| | ● | The affirmative vote of a majority of the shares of stock entitled to vote thereon which are present in person via attendance at the Annual Meeting or represented by proxy at the Annual Meeting is required to ratify the appointment of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm. |

| | ● | The affirmative vote of a majority of the shares of stock entitled to vote thereon which are present in person via attendance at the Annual Meeting or represented by proxy at the Annual Meeting is required to approve, on an advisory basis, the compensation of our named executive officers. While this vote is advisory and not binding on us or our Board, the Board and Compensation Committee intend to take into account the outcome of the vote when considering future executive compensation arrangements. |

Under the General Corporation Law of the State of Delaware, both abstaining votes and broker non-votes are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting. An abstaining vote is not counted as a vote cast for the election of directors, but has the same effect as a vote cast against each of the other proposals requiring approval by a majority of the shares of stock entitled to vote thereon which are present in person via attendance at the Annual Meeting or represented by proxy at the Annual Meeting, such as the ratification of our independent registered public accounting firm.Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. A broker non-vote is not counted as a vote cast forwill have no effect on the electionoutcome of directors or as being present and entitled to vote for proposals requiring approval by a majority of the shares of stock entitled to vote thereon which are present in person or represented by proxy at the Annual Meeting and, therefore, does not have the effect of a vote against such proposals. For purposes of ratifying our independent registered public accounting firm, brokers have discretionary authority to vote. Stockholder List A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours at 4040at: 5808 Lake Washington Boulevard NE, Suite 201, Kirkland, Washington 98033 for the ten days prior to the Annual Meeting, and also at the Annual Meeting. PROPOSAL ONE ELECTION OF DIRECTORS Classified Board of Directors; Nominees The Board currently consists of six members. Under our certificateCertificate of incorporationIncorporation and bylaws,Bylaws, the Board has the authority to set the number of directors from time to time by resolution. In addition, our certificateCertificate of incorporationIncorporation provides for a classified Board consisting of three classes of directors, each serving staggered three-year terms. As a result, a portion of the Board will be elected each year for three-year terms. Two Class IIIII directors are to be elected to the Board at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Board’s nominees,, Herbert Chang Eugen Elmiger and Michael HsingJeff Zhou. Mr. ChangElmiger and Mr. HsingZhou are standing for re-election to the Board. Each person nominated for election has agreed to serve if elected, and the Board has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the current Board to fill the vacancy. The term of office of each person elected as a Class IIIII director will continue for three years or until his successor has been duly elected and qualified. If elected, the term for Mr. ChangElmiger and Mr. HsingZhou will expire at the 20222024 annual meeting of stockholders. Our directors are elected by a “plurality” vote. The nominees for each of the two Board seats to be voted on at the Annual Meeting receiving the greatest number of votes cast will be elected. Abstentions and shares held by brokers that are not voted in the election of directors will have no effect. In addition, we have adopted a corporate governance policy requiring each director nominee to submit a resignation letter if more “Withheld” than “For” votes are received. See the section ““Director Voting Policy”Policy” for more details on this policy. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR”“FOR” THE ELECTION TO THE BOARD OF EACH OF THE PROPOSED NOMINEES. Information Regarding Nominees and Other Directors The following table summarizes certain information regarding the nominees and other directors: Name | | Age | | Director Since | | Principal Role | | Age | | Director Since | | Principal Role | Michael Hsing | | 59 | | 1997 | | Chairman of the Board, President and Chief Executive Officer / Nominee | | 61 | | 1997 | | Chairman of the Board, President and Chief Executive Officer | Herbert Chang (1)(2)(3) | | 57 | | 1999 | | Lead Director / Nominee | | 59 | | 1999 | | Lead Director | Eugen Elmiger (1)(3) | | 55 | | 2012 | | Director | | 57 | | 2012 | | Director / Nominee | Victor K. Lee (2) | | 62 | | 2006 | | Director | | 64 | | 2006 | | Director | James C. Moyer | | 76 | | 1998 | | Director | | 78 | | 1998 | | Director | Jeff Zhou (1)(2) | | 64 | | 2010 | | Director | | 66 | | 2010 | | Director / Nominee |

(1) | Member of the Compensation Committee. |

(2) | Member of the Audit Committee. |

(3) | Member of the Nominating and Governance Committee (the “Nominating Committee”). |

Nominees for Class II Directors Whose Term Will Expire in2021 Eugen Elmiger has served on our Board since October 2012. Mr. Elmiger currently serves as Chief Executive Officer of Maxon group, a leading advanced motion company, a position that he has held since January 2011. Mr. Elmiger currently serves on the Board of Directors of Kardex, a global leader in automated storage solutions and material handling systems. Mr. Elmiger holds a B.S. in Electrical Engineering from the Lucerne (Horw) University of Applied Science and Art. Jeff Zhou has served on our Board since February 2010. Dr. Zhou is a retired business executive. Before his retirement, Dr. Zhou served as Executive Vice Chairman of MiaSolé, which develops thin film solar technology, a position he held from 2018 to 2019. Dr. Zhou served as Chief Executive Officer of MiaSolé from 2013 to 2018. Before joining MiaSolé, Dr. Zhou was President of Hanergy Holding America, Inc., a developer and operator of solar power plants, from 2012 to 2013. Dr. Zhou also served as Executive Chairman of Alta Devices, a developer of flexible mobile power technology, from 2014 to 2015. Dr. Zhou holds a Ph.D. degree in Electrical Engineering from the University of Florida. Incumbent Class III Directors Whose Term Will Expire in 20192022

Michael Hsing has served on our Board and as our President and Chief Executive Officer since founding MPS in August 1997. Prior to founding MPS, Mr. Hsing was a Senior Silicon Technology Developer at several analog integrated circuits (“IC”) companies, where he developed and patented key technologies, which set new standards in the power electronics industry. Mr. Hsing is an inventor on numerous patents related to the process development of bipolar mixed-signal semiconductor manufacturing. Mr. Hsing holds a B.S.E.E. from the University of Florida.

Herbert Changhas served on our Board since September 1999. SinceFrom March 2014 until December 2019, Mr. Chang has beenwas the general manager of Mutto Optronics Corporation, an OEM/ODM knife manufacturer listed in on the Taiwan OTC. Mr. Chang iswas also a Managing Member of Growstar Associates, Ltd., which was the General Partner and the Fund Manager of VCFA Growth Partners , L.P. from 2007 to 2013 and iswas the Chief Executive Officer of C Squared Management Corporation. Mr. Chang’s companies focus on investing in companies in the semiconductor, telecommunications, networking software, and/or Internet industries. Mr. Chang was the President of InveStar Capital, Inc. from April 1996 until 2015 and serves on the board of directors of a number of private companies. Mr. Chang received a B.S. in geology from National Taiwan University and an M.B.A. from National Chiao Tung University in Taiwan. Incumbent Class I Directors Whose Terms Will Expire in 20202023 Victor K. Leehas served on our Board since September 2006. Mr. Lee was a member of the board of directors at MoSys, Inc., a fabless semiconductor company from June 2012 to June 2016. Mr. Lee served as Chief Financial Officer of Ambarella, Inc., a fabless semiconductor company, from August 2007 to March 2011. From December 2002 through June 2007, Mr. Lee served as Chief Financial Officer and Secretary of Leadis Technology Inc., a fabless semiconductor company. From December 1999 to January 2001, Mr. Lee served as the Chief Financial Officer and Secretary of SINA Corporation, an Internet media company. From September 1998 to August 1999, Mr. Lee was the Vice President and Acting Chief Financial Officer of VLSI Technology, Inc., a semiconductor manufacturer, and from 1997 to 1998, Vice President, Corporate Controller of VLSI Technology, Inc. From 1989 to 1997, Mr. Lee was a finance director at Advanced Micro Devices, Inc. Mr. Lee holds a B.S. in Industrial Engineering and Operations Research and an M.B.A. from the University of California, Berkeley. James C. Moyerhas served on our Board since October 19981998. Mr. Moyer is a retired business executive and served as our Chief Design Engineer from September 1997 tountil his retirement from MPS in January 2016. Before joining MPS, from June 1990 to September 1997, Mr. Moyer held senior technical positions at Micrel, Inc. Prior to that, Mr. Moyer held senior design engineering positions at Hytek Microsystems Inc., National Semiconductor Corporation, and Texas Instruments Inc. Mr. Moyer holds a B.A.E.E. from Rice University. Incumbent Class II Directors Whose Term Will Expire in 2021

Eugen Elmiger has served on our Board since October 2012. Mr. Elmiger currently serves as Chief Executive Officer of Maxon group, a leading advanced motion company, a position that he has held since January 2011. From 1991 to 2011, Mr. Elmiger held senior executive positions in the sales, marketing and engineering divisions of Maxon motor. Mr. Elmiger holds a B.S. in Electrical Engineering from the Lucerne (Horw) University of Applied Science and Art.

Dr. Jeff Zhou has served on our Board since February 2010. Dr. Zhou currently serves as the Executive Vice Chairman of Miasolé, which develops thin film solar technology, a position he has held since 2018. Dr. Zhou served as the Chief Executive Officer of MiaSolé from 2013 to 2018. Dr. Zhou also served as Executive Chairman of Alta Devices, a developer of flexible mobile power technology, from 2014 to 2015. Before joining MiaSolé, Dr. Zhou was President of Hanergy Holding America, Inc., a developer and operator of solar power plants, from 2012 to 2013. Dr. Zhou was Vice President of Product Engineering of Nanosolar, Inc., a developer of solar power technology, from 2011 to 2012. Dr. Zhou was Chief Operating Officer at NDS Surgical Imaging, a medical imaging technology company, during 2010. From 2008 to 2009, Dr. Zhou was Vice President of Global Engineering and General Manager of Asia Pacific Business at NDS Surgical Imaging. From 2005 to 2007, Dr. Zhou was Vice President of Engineering for several business divisions and General Manager of the China and India Design Centers at Flextronics Inc. From 2000 to 2005, Dr. Zhou was Vice President and General Manager of several divisions at Honeywell International Inc. Dr. Zhou holds a Ph.D. degree in Electrical Engineering from the University of Florida.

There is no family relationship among any of our executive officers, directors and nominees. Appointment of a Female Director in 2021 We believe diversity drives innovation and is key to our success. Currently, the Board consists of members with a wide variety of skills, industry experiences and backgrounds. We are committed to diversity and inclusion at every level of MPS, including the Board. Our Nominating Committee has been actively recruiting a female Board member, with the assistance of the full Board, our management team and a retained search firm. We believe a diverse, balanced and cohesive Board is critical in facilitating strong oversight, as well as supporting the achievement of MPS’s objectives, including its strategic priorities to improve long-term operational and financial performance and enhance stockholder interests. Our philosophy ensures each Board member’s individual interests are represented and their perspectives and opinions are valued. To accomplish this goal, the Board believes it is important to conduct in-person meetings (in addition to virtual meetings) in order to have the necessary interactions to evaluate the candidates, review their qualifications thoroughly, build trust and develop a strong relationship with existing Board members. This important process has been made more challenging by the COVID-19 pandemic, as the majority of candidates considered to date and many of our Board members are located in Asia and Europe where there are strict travel restrictions and shelter-in-place orders. We recognize the importance of moving the recruiting process forward and are taking practical steps to reach the final stage. The Board is fully committed to completing its search to appoint one female Board member before the end of 2021. Race/Ethnic Composition Currently, 67% of our directors are Asian and 33% are White. Director Independence At least annually, the Nominating Committee reviews the independence of each non-employee director and makes recommendations to the Board, and the Board affirmatively determines whether each director qualifies as independent. Each director must keep the Nominating Committee fully and promptly informed as to any development that may affect the director’s independence. The Board has determined that each of Herbert Chang, Eugen Elmiger, Victor K. Lee, James C. Moyer and Jeff Zhou are “independent” under the applicable listing standards of The NASDAQ Stock Market. Director Qualifications Our Board includes six members who are well-qualified to serve on the Board and represent our stockholders’ best interests. Our Board consists of directors who have the following characteristics: | | 1. | Possess a professional background that would enable the development of a deep understanding of our business; |

| | 2. | Bring diversity to the Board through their experiences in various industries, both domestically and internationally; |

| | 3. | Are independent thinkers and work well together; |

| | 4. | Have the ability to embrace our values and culture; |

| | 5. | Have high ethical standards; |

| 6. | Have skills or experience in risk management; |

| | 6.7.

| Possess sound business judgment and acumen; and |

| | 7.8.

| Are willing to commit their time and resources necessary for the Board to effectively fulfill its responsibilities. |

We believe that each of the director nominees and the rest of the directors possess these attributes. In addition, the directors bring to the Board a breadth of experience, including extensive financial and accounting expertise, public company board experience, knowledge of the semiconductor business and technology, broad global experience, and extensive operational and strategic planning experience, and the ability to assess and manage business risks, including risks related to cybersecurity and information security, in complex, high-growth global companies. The Board and the Nominating Committee believe the skills, qualities, attributes, experience and diversity of backgrounds of our directors provide us with a diverse range of perspectives to effectively address our evolving needs and represent the best interests of our stockholders. The following describes the key qualifications, business skills, experience and perspectives that each of our directors and director nominees brings to the Board, in addition to the general qualifications described above and described in their individual biographies: Michael Hsing:Hsing | Mr. Hsing, the co-founder of MPS, is a visionary in power management technology as well as a strong leader, motivator and successful entrepreneur. Mr. Hsing provides the Board with valuable insight into management’s perspective with respect to our operations, and he provides the Board with the most comprehensive view of our operational history. Under his leadership, we have experienced significant revenue growth and profitability. Since our initial public offering in 2004, stockholder value measured by market capitalization has increased significantly. Having worked in the semiconductor industry for over 30 years, Mr. Hsing’s experiencevision, insight and insightexperience enable him to understand how toand expand the markets we serve, control costs effectively, assess and manage business risks, including risks related to information technology and cybersecurity, and maximize our technology advantages for our products, which hashave helped to fuel our growth and created value for our stockholders. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Hsing should serve as a director of MPS. |

| | Herbert Chang:Chang | Mr. Chang has been a member of the Board since 1999, which gives him significant knowledge of our recent experiences and history. We also continue to benefit from the broad experience gained by Mr. Chang through his numerous successful investments in both public and private high-technology companies. Mr. Chang has served on several boards of the companies in which he has invested, which has given him significant leadership skills, risk management and oversight experience. In addition, through these board and investor responsibilities, Mr. Chang has developed a deep knowledge of our industry, our operations, and the accompanying complex financial transactions and controls necessary for us to succeed. Mr. Chang’s financial expertise has also helped the Board analyze significant complex financial transactions that we have considered from time to time. Mr. Chang also has very relevant international experience based on his educational background and work experience in the countries where we do business. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Chang should serve as a director of MPS. |

| | Eugen Elmiger | Mr. Elmiger is a seasoned business executive with over 30 years of experience, including extensive international marketing, sales and product management expertise, executive board experience, knowledge of high-tech component business and technology, broad global experience and operational and strategic planning experience, including the oversight of information technology and cybersecurity, in complex, high-growth global companies. This experience allows him to contribute his valuable executive leadership talent, risk management and understanding of international business to Board deliberations.deliberations and oversight duties. His industrial, medical and automotive background is a valuable asset to the Board as we expand our business in these markets. Mr. Elmiger’s appointment to the Board also allows him to bring a new perspective, new ideas and outlooks to the Board. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Elmiger should serve as a director of MPS. | | |

Victor K. Lee:Lee | Mr. Lee is the audit committee financial expert on the Audit Committee of the Board. He has been the Chief Financial Officer at several public and private companies, and has worked in the semiconductor industry for over 30 years. Mr. Lee is familiar with not only the inner workings of the industry, but also has intimate knowledge of the financial issues and business risks that semiconductor companies often face. His experience has allowed him to understand the broad issues, in particular those affecting the financial and accounting aspects of our business, that the Board must consider and to make sound recommendations to management and the Board. Mr. Lee also provides the Board with valuable insight into financial management, risk management, disclosure issues and tax matters relevant to our business. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Lee should serve as a director of MPS. | | | James C. Moyer:Moyer | Mr. Moyer is a technical expert in the design of analog semiconductors. As co-founder of MPS, Mr. Moyer is intimately familiar with us and our products. Mr. Moyer brings insight to the Board because of his cumulative experience gained as an engineer and technical leader in the semiconductor industry. This experience gives him a highly developed understanding of the needs and requirements of the analog market for our complex products and allows him as a director to lead us in the right direction in terms of strategy and business approach. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Moyer should serve as a director of MPS. |

Dr. Jeff Zhou:Zhou | Dr. Zhou is a senior business executive with over 30 years of industry experience at large, multi-national corporations with global footprints. Dr. Zhou has an extensive background in the global manufacturing, electronics and electronicsrenewable energy industry. This experience allows him to contribute his valuable executive leadership talent, risk management skills, including the oversight of information technology and cybersecurity, and understanding of international business to Board deliberations.deliberations and oversight duties. Dr. Zhou’s appointment to the Board also allows him to bring a new perspective, new ideas and new outlooks to the Board. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Dr. Zhou should serve as a director of MPS. |

Board Leadership Structure The Board currently consists of six members, five of which the Board has determined are independent. Leadership Structure. Our current leadership structure and governing documents permit the roles of Chairman and Chief Executive Officer to be filled by the same or different individuals. The Board has currently determined that it is in the best interests of MPS and our stockholders to have Michael Hsing, our President and Chief Executive Officer, serve as Chairman, coupled with an active Lead Independent Director. As such, Mr. Hsing holds the position of Chairman, President and Chief Executive Officer, and the Board has designated one of the independent directors, Mr. Herbert Chang, as the Lead Independent Director. Our Lead Independent Director becauseis appointed by the Board on an annual basis. The Board believes our Presidentleadership structure, with its strong emphasis on Board independence, an active Lead Independent Director, and Chief Executive Officer, Mr. Hsing, also serves as the Chairman of the Board. We believe that the number of independent, experienced directors that make up ourstrong Board along with the independentand committee involvement, provides sound and robust oversight of our Lead Director, benefits usmanagement, and our stockholders by providingprovides a counterbalance to the management perspective provided by Mr. Hsing during Board deliberations. The Board considers and discusses the leadership structure every year. As part of this evaluation process, the Board reviews its leadership structure and whether combining or separating the roles of Chairman and CEO is in the best interests of the Company and our stockholders. The Board also considers: | ● | The effectiveness of the policies, practices, and people in place at MPS to help ensure strong, independent Board oversight; |

| ● | MPS’s performance and the effect the leadership structure could have on its performance; |

| ● | The Board’s performance and the effect the leadership structure could have on the Board’s performance; |

| ● | The Chairman’s performance in the role; |

| ● | The views of MPS’s stockholders; and |

| ● | The practices at other companies and trends in governance. |

Should the Board determine that it remains in the best interests of the Company and its stockholders that the Chief Executive Officer serve as Chairman, the independent members of the Board then elect a Lead Independent Director. We recognize that different board leadership structures may be appropriate for different companies. We believe that our current Board leadership structure is optimal for us. Our leadership structure demonstrates to our employees, suppliers, customers, stockholders and other stakeholders that we are governed by strong, balanced leadership, with a single person setting the tone and consistent message for the Board and management and having primary responsibility for managing our day-to-day operations.operations, with appropriate oversight and direction from our Lead Independent Director and other independent directors. This message is increasingly important as we continue to seek to achieve business success through new product releases and gaining market share in our industry. At the same time,We also believe that our leadership structure sends the message that we also value strong, independent oversight of our management operations and decisions in the form of our Lead Independent Director. Further, having a single leader for both MPS and the Board eliminates the potential for strategic misalignment or duplication of efforts, and provides clear leadership for us. Benefits of Combined Leadership Structure. The Board believes that MPS and our stockholders have been best served by having Mr. Hsing in the role of Chairman and Chief Executive Officer for the following reasons: | ● | Mr. Hsing is most familiar with our business and the unique challenges we face. Mr. Hsing’s day-to-day insight into our challenges facilitates a timely deliberation by the Board of important matters. |

| ● | Mr. Hsing has and will continue to identify agenda items and lead effective discussions on the important matters affecting us. Mr. Hsing’s knowledge and extensive experience regarding our operations and the highly competitive semiconductor industry in which we compete position him to identify and prioritize matters for Board review and deliberation. |

| ● | As Chairman and Chief Executive Officer, Mr. Hsing serves as an important bridge between the Board and management and provides critical leadership for carrying out our strategic initiatives and confronting our challenges. The Board believes that Mr. Hsing brings a unique, stockholder-focused insight to assist MPS to most effectively execute its strategy and business plans to maximize stockholder value. |

| ● | The strength and effectiveness of the communications between Mr. Hsing, as our Chairman, and Mr. Chang, as our Lead Independent Director, as well as our other independent directors, result in comprehensive Board oversight of the issues, plans, and prospects of MPS. |

| ● | This leadership structure provides the Board with more complete and timely information about MPS, a unified structure and consistent leadership direction internally and externally and provides a collaborative and collegial environment for Board decision making. |

Lead Independent Director Responsibilities. As discussed above, the positions of Chairman of the Board, President and Chief Executive Officer are held by Mr. Hsing, and the Board has appointed a Lead Independent Director, Mr. Chang. Mr. Chang’s roles and responsibilities as the Lead Independent Director include: | | 1. ●

| Reviewing meeting agendas,agendas; |

| ● | Reviewing schedules and information sent to the Board; |

| | 2. ●

| Retaining independent advisors on behalf of the Board, or committees, as the Board may determine is necessary or appropriate; |

| | 3. ●

| Assuring that there is sufficient time for discussion of all meeting agenda items; |

| ● | Ensuring personal availability for consultation and communication with independent directors and with the Chairman of the Board, as appropriate; |

| | 4. ●

| Performing such other functions as the independent directors may designate from time to time; |

| | 5. ●

| Presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; and |

| | 6.

| Serving as liaison between the Chairman and independent directors;

|

| 7. ●

| Calling meetings of independent directors; and |

| 8.

| Ensuring that the Board is at least two-thirds independent and that key committees are independent.directors.

|

Our independent directors meet in executive session during a portion of every regularly scheduled Board meeting, and otherwise as needed. Our Lead Independent Director presides over meetings of our independent directors and we believe that these meetings help to ensure an appropriate level of independent scrutiny of the functioning of the Board. Board Oversight of Risk The Board is primarily responsible for the oversight of risks that could affect MPS. Our senior management team, which conducts our day-to-day risk management, is responsible for assisting the Board with its risk oversight function. ThisThe Board believes that a fundamental part of risk management is understanding the risks that we face, monitoring these risks, and adopting appropriate controls and mitigation activities for such risks. We believe that the risk management areas that are fundamental to the success of our enterprise include the areas of product development, supply and quality, sales and promotion, and business development, as well as protecting our assets (financial, intellectual property, and information, including cybersecurity), all of which are managed by senior executive management reporting directly to our Chief Executive Officer. Our Board members have extensive experience in risk oversight arising from their current or prior experience as a Chief Executive Officer, Chief Financial Officer, other senior leadership position or board member of other companies, with responsibility for risk oversight obligations. As such, the Board believes that its members are qualified and experienced at identifying and addressing risk throughout MPS’s operations. The Board’s oversight is conducted principally through committees of the Board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees, but the full Board has retained responsibility for general oversight of risk. The Board satisfies its responsibility by requiring each committee chair to regularly report regarding the committee’s considerations and actions, as well as by requiring officers responsible for oversight of particular risks within MPS to submit regular reports. As these reports are submitted independent of review by Mr. Hsing, our President, Chief Executive Officer and the Chairman of the Board, the Board believes that itsthe conduct of its risk oversight function has no impact on the Board’s leadership structure other than to reinforce the involvement of the Board in ongoing management of MPS. In addition to requiring regular reporting from committees and officers, the Board also hears from third-party advisors in order to maintain oversight of risks that could affect us, including our independent auditors, outside counsel, compensation consultants and others. These advisors are consulted on a periodic basis, and as particular issues arise, in order to provide the Board with the benefit of independent expert advice and insights on specific risk-related matters. At its regularly scheduled meetings, the Board also receives management updates on the business, including operational and environmental, social and governance (“ESG”) issues, financial results, cybersecurity and information security matters, and business outlook and strategy. These updates enable our Board to discuss enterprise risks with our senior management on a regular basis, including as a part of its annual strategic planning process and annual budget review. For a discussion of the Board’s oversight of our ESG compliance efforts, refer to the section “Corporate Social Responsibility.” Our Audit Committee also assists the full Board in its oversight of risk by discussing with management our compliance with legal and regulatory requirements, our policies with respect to risk assessment and management of business risks that may affect us, including risks related to information technology and cybersecurity, and our system of disclosure control and system of controls over financial reporting. Risks related to our company-wide compensation programs are reviewed by our Compensation Committee. For more information on the Compensation Committee’s compensation risk assessment, see the section ““Named Executive Officer Compensation – Compensation Risk Management.” Our Nominating Committee provides compliance oversight and reports to the full Board on compliance and makes recommendations to our Board on corporate governance matters, including director nominees, the determination of director independence, and board and committee structure and membership. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing us and that the Board leadership structure supports this approach. Board Meetings and Committees The Board held a total of four meetings during 2018,2020, and all directors attended at least 75% of the meetings of the Board and the committees upon which such director served. Audit Committee. The Board has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the 1934 Act, which currently consists of three members: Herbert Chang, Victor K. Lee and Jeff Zhou. Mr. Lee is the chairman of the Audit Committee. This committee oversees our financial reporting process and procedures, is responsible for the appointment and terms of engagement of our independent registered public accounting firm, reviews our financial statements, and coordinates and approves the activities of our independent registered public accounting firm. The Board has determined that Mr. Lee is an “audit committee financial expert,” as defined under the rules of the SEC, and all members of the Audit Committee are “independent” in accordance with the applicable SEC regulations and the applicable listing standards of NASDAQ. The Audit Committee held four meetings during 2018.2020. The Audit Committee acts pursuant to a written charter adopted by the Board, which is available in the “Investor Relations” section of our website at http://www.monolithicpower.com. Compensation Committee. The Board has designated a Compensation Committee consisting of three members: Herbert Chang, Eugen Elmiger and Jeff Zhou. Mr. Zhou is the chairman of the Compensation Committee. This committee is responsible for providing oversight of our compensation policies, plans and benefits programs and assisting the Board in discharging its responsibilities relating to (a) oversight of the compensation of our Chief Executive Officer and other executive officers, and (b) approving and evaluating the executive officer compensation plans, policies and programs of MPS. The committeeCompensation Committee also assists the Board in administering our stock plans and employee stock purchase plan. In 2020, we expanded the role of the Compensation Committee to include the oversight of our ESG practices and compliance efforts with respect to executive compensation policies and programs. All members of the Compensation Committee are “independent” in accordance with the applicable listing standards of NASDAQ. The Compensation Committee held four meetings during 2018.2020. The Compensation Committee acts pursuant to a written charter adopted by the Board, which is available in the “Investor Relations” section of our website at http://www.monolithicpower.com. Nominating Committee. The Board has designated a Nominating Committee consisting of two members: Herbert Chang and Eugen Elmiger. Mr. Elmiger is the chairman of the Nominating Committee. This committee is responsible for the development of general criteria regarding the qualifications and selection of Board members, recommending candidates for election to the Board, developing overall governance guidelines and overseeing the overall performance of the Board. In 2020, we expanded the role of the Nominating Committee to include the oversight of our ESG practices and compliance efforts with respect to human capital management, including company culture, talent development and diversity initiatives. All members of the Nominating Committee are “independent” in accordance with the applicable listing standards of NASDAQ. The Nominating Committee held four meetings in 2018.2020. The Nominating Committee acts pursuant to a written charter adopted by the Board, which is available in the “Investor Relations” section of our website at http://www.monolithicpower.com. The information contained on our website is not intended to be part of this Proxy Statement and is not incorporated by reference into this Proxy Statement. Nomination Process The Board has adopted guidelines for the identification, evaluation and nomination of candidates for director. The Nominating Committee considers the suitability of each candidate, including any candidates recommended by stockholders holding at least 5% of the outstanding shares of our voting securities continuously for at least 12 months prior to the date of the submission of the recommendation for nomination. If the Nominating Committee wishes to identify new independent director candidates for Board membership, it is authorized to retain and approve fees of third party executive search firms to help identify prospective director nominees. the Board that our Lead Independent Director interviews each Board candidate. In April 2018, in response to shareholders’stockholders’ feedback, the Board considered and adopted an amendment to the Nominating Committee Charter (available in the “Investor Relations” section of our website at http://www.monolithicpower.com) on the evaluation of prospective candidates. In addition to the minimum qualifications the Nominating Committee has established for director nominees, the Nominating Committee will also consider whether the prospective nominee will foster a diversity of genders, backgrounds, skills, perspectives and experiences in the process of its evaluation of each prospective nominee. The Nominating Committee also focuses on skills, expertise or background that would complement the existing Board, recognizing that our businesses and operations are diverse and global in nature. While there are no specific minimum qualifications for director nominees, the ideal candidate should (a) exhibit independence, integrity, and qualifications that will increase overall Board effectiveness, and (b) meet other requirements as may be required by applicable rules, such as financial literacy or expertise for audit committee members. The Nominating Committee uses the same process for evaluating all nominees, regardless of the original source of the nomination. After completing its review and evaluation of director candidates, the Nominating Committee recommends to the Board the director nominees for selection. A stockholder that desires to recommend a candidate for election to the Board should direct such recommendation in writing to Monolithic Power Systems, Inc., 40405808 Lake Washington Boulevard NE, Suite 201, Kirkland, Washington 98033, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and us within the last three years and evidence of the nominating person’s ownership of our stock. Such stockholder nomination must be made pursuant to the notice provisions set forth in our Bylaws and for each proposed nominee who is not an incumbent director, the stockholder’s notice must set forth all of the information regarding such nominating person and proposed nominee set forth in our Bylaws. Stockholder Communications The Board has approved a Stockholder Communication Policy to provide a process by which stockholders may communicate directly with the Board or one or more of its members. You may contact any of our directors by writing to them at c/o Monolithic Power Systems, Inc., 40405808 Lake Washington Boulevard NE, Suite 201, Kirkland, Washington 98033, Attention: Corporate Secretary. Any stockholder communications that the Board is to receive will first go to the Corporate Secretary, who will log the date of receipt of the communication as well as the identity of the correspondent in our stockholder communications log. The Corporate Secretary will review, summarize and, if appropriate, draft a response to the communication in a timely manner. The Corporate Secretary will then forward copies of the stockholder communication to the Board member(s) (or specific Board member(s) if the communication is so addressed) for review, provided that such correspondence concerns the functions of the Board or its committees, or otherwise requires the attention of the Board or its members. Attendance at Annual Meetings of Stockholders by the Board of Directors We do not have a formal policy regarding attendance by members of the Board at our annual meetings of stockholders. In 2018,2020, no Board members attended the Annual Meeting. Code of Ethics and Business Conduct We have adopted a Code of Ethics and Business Conduct, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. The Code of Ethics and Business Conduct is available in the “Investor Relations – Corporate Governance” section of our website at http://www.monolithicpower.com. We will disclose on our website any amendment to the Code of Ethics and Business Conduct, as well as any waivers of the Code of Ethics and Business Conduct, that are required to be disclosed by the rules of the SEC or NASDAQ. Policy on Hedging We have adopted a policy that prohibits our directors, officers (including our NEOs), and other employees from engaging in hedging or monetization transactions with respect to our stock that they obtained through our plans or otherwise, without prior approval by our Chief Compliance Officer. We also prohibit our directors and officers, including our NEOs, from engaging in any short sales of our stock. Director Voting Policy The Board has adopted a director voting policy, which can be found in the “Investor Relations – Corporate Governance” section of our website at http://www.monolithicpower.com. The policy establishes that any director nominee who receives more “Withheld” votes than “For” votes in an uncontested election held in an annual meeting of stockholders shall promptly tender his or her resignation. The independent directors of the Board will then evaluate the relevant facts and circumstances and make a decision, within 90 days after the election, on whether to accept the tendered resignation. The Board will promptly publicly disclose its decision and, if applicable, the reasons for rejecting the tendered resignation. 2020 Director Compensation Analysis of 20182020 Compensation Elements For 2018,2020, the Board engaged Radford, an Aon Hewitt company,independent compensation consultant, to review theour non-employee director compensation. In its analysis, Radford gathered the market data onrelating to the size and type of compensation paid by our industry peer group for 20182020 (see the section ““Named Executive Officer Compensation — Peer GroupGroup and Use of Peer Data for 20202018” for more information on the selection of the peer group). Based on its review of the results of this market review and recommendations by Radford, the Board approved the following changes to the compensation changes for our non-employee directors for serviceservices rendered in 2018: (i) increase the annual board retainer fee from $45,000 to $50,000, (ii) increase the lead director fee from $12,000 to $18,000, (iii) increase the Audit Committee chairperson fee from $22,500 to $25,000, and (iv) increase the annual RSU grant to incumbent directors from 140,000 to 175,000. Accordingly, the compensation paid to our non-employee directors for service in 2018 was as follows:2020: Fee Description

| | Amount

| Annual board retainer fee

| | $50,000

| Lead director fee

| | $18,000

| Compensation Committee chairperson fee

| | $18,000

| Compensation Committee membership fee (excluding chairperson)

| | $8,000

| Nominating Committee chairperson fee

| | $13,500

| Nominating Committee membership fee (excluding chairperson)

| | $6,000

| Audit Committee chairperson fee

| | $25,000

| Audit Committee membership fee (excluding chairperson)

| | $10,500

| Initial restricted stock unit (“RSU”) grant to new directors

| | Number of RSUs equal to $175,000

| Annual RSU grant to incumbent directors

| | Number of RSUs equal to $175,000

|

Fee Description | | FY 2020 ($) | | FY 2019 ($) | | Change ($) | | Annual Board retainer fee | | | 70,000 | | | 50,000 | | | 20,000 | | Lead Independent Director fee | | | 20,000 | | | 18,000 | | | 2,000 | | Compensation Committee chairperson fee | | | 20,000 | | | 18,000 | | | 2,000 | | Compensation Committee membership fee (excluding chairperson) | | | 10,000 | | | 8,000 | | | 2,000 | | Nominating Committee chairperson fee | | | 15,000 | | | 13,500 | | | 1,500 | | Nominating Committee membership fee (excluding chairperson) | | | 7,500 | | | 6,000 | | | 1,500 | | Audit Committee chairperson fee | | | 30,000 | | | 25,000 | | | 5,000 | | Audit Committee membership fee (excluding chairperson) | | | 15,000 | | | 10,500 | | | 4,500 | | Restricted stock unit (“RSU”) grant value to new directors | | | 200,000 | | | 175,000 | | | 25,000 | | Annual RSU grant value to incumbent directors | | | 200,000 | | | 175,000 | | | 25,000 | |

The initial grant of RSUs to new directors vestvests as to 50% of the underlying shares of Common Stock on each of the first and second anniversaries of the date of grant. The annual grant of RSUs to incumbent directors vests as to 100% of the underlying shares of Common Stock on the first anniversary of the date of the grant. All awards will become fully vested in the event of a change in control. All of our non-employee directors are subject to stock ownership guidelines that are described below in the section ““Named Executive Officer Compensation — Compensation Discussion and Analysis — Stock Ownership Guidelines.” The following table sets forth the total compensation paid tofor each non-employee director for serviceservices rendered in 2018.2020. Mr. Hsing, who is our employee, does not receive additional compensation for his services as a director. Mr. Hsing’s compensation as a named executive officer is reflected in the section ““Named Executive Officer Compensation — 2020 Summary Compensation Table.” Name | | Fees Earned or Paid in Cash | | | Stock Awards (1) | | | Total | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Total ($) | | Herbert Chang | | $ | 92,500 | | | $ | 175,000 | | | $ | 267,500 | | | | 122,500 | | | | 200,000 | | | | 322,500 | | Eugen Elmiger | | $ | 71,500 | | | $ | 175,000 | | | $ | 246,500 | | | | 95,000 | | | | 200,000 | | | | 295,000 | | Victor K. Lee | | $ | 75,000 | | | $ | 175,000 | | | $ | 250,000 | | | | 100,000 | | | | 200,000 | | | | 300,000 | | James C. Moyer | | $ | 50,000 | | | $ | 175,000 | | | $ | 225,000 | | | | 70,000 | | | | 200,000 | | | | 270,000 | | Jeff Zhou | | $ | 78,500 | | | $ | 175,000 | | | $ | 253,500 | | | | 105,000 | | | | 200,000 | | | | 305,000 | |

| | (1) | Reflects the aggregate grant date fair value of the awards granted to each director in 2018,2020, computed in accordance with Financial Accounting Standards Board (“FASB”) ASC Topic 718, which was calculated using the closing price of our Common Stock on February 12, 2020, the date of grant for such awards. Assumptions used in the calculation of these amounts are included in Note 1 and Note 78 to the financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2018,2020, filed with the SEC on March 1, 2019.2021. |

The following table summarizes the number of shares of our Common Stock that are subject to unvested RSU awards held by each of the non-employee directors as of December 31, 2018:2020: Name | | Stock Awards (#) | | Herbert Chang | | | 1,5901,048 | | Eugen Elmiger | | | 1,5901,048 | | Victor K. Lee | | | 1,5901,048 | | James C. Moyer | | | 1,5901,048 | | Jeff Zhou | | | 1,5901,048 | |

CORPORATE SOCIAL RESPONSIBILITY Since MPS was founded in 1997, one of our core values has been to run a responsible and responsive business for the long term. We believe that positive ESG business practices strengthen our company and foster strong relationships with our stockholders, employees, business partners and communities where we operate. We are committed to making our workforce diverse, our business sustainable and our stakeholders engaged by maintaining strong ESG practices and policies, some of which are highlighted below: Environmental | ● | In 2017, we began tracking our greenhouse gas emissions and submitting annual Carbon Disclosure Project reports for our largest facility in Chengdu, China. From 2017 to 2019, while the production volume at our Chengdu facility increased, Scope 1 GHG emissions produced at this location and Scope 2 emissions from our use of purchased electricity increased at a slower rate. | | ● | We are ISO 14001 certified and we regularly audit our key manufacturing suppliers’ wafer fabrication and assembly facilities to evaluate and confirm that their social responsibility practices and environmental systems comply with important industry standards. | | ● | Our products are shipped in compliance with European RoHS (“Restriction of Hazardous Substances”) legislation and exclude banned substances. | | ● | At our largest U.S. facility in San Jose, California, we installed 30,000 square feet of solar panels. In addition, we installed over 26 EV charging stations in San Jose, California and at our corporate headquarters in Kirkland, Washington. We continue to identify other opportunities to implement additional renewable energy projects for our global facilities. | | ● | In 2021, we plan to establish, develop and implement a long-term environmental and climate change policy that focuses on hazardous material waste management, greenhouse gas emission, and energy consumption. | | Social | ● | We participate in the Equal Employment Opportunity-1 (“EEO-1”) survey each year. As of December 31, 2020, women in engineering/technical and managerial/ supervisor roles comprised approximately 22% and 22%, respectively, of our worldwide workforce, and held approximately 57% of total non-technical roles at MPS. We employ women engineers and technologists at a similar rate as our peers in the semiconductor industry. We continually recruit new talent from a diverse candidate pool. | | ● | Our Conflict Minerals Policy prohibits the use of cobalt and other conflict minerals originating from the Democratic Republic of the Congo or adjoining countries. We require this same certification from all our key manufacturing suppliers. | | ● | Our Worker Health and Safety Plan is certified to ISO 45001 standards. | | ● | In 2020, we established the MPS charitable foundation with the mission to give back to our communities by supporting many non-profit organizations. | | ● | Our key manufacturing suppliers are required to sign our Vendor Code of Conduct to certify their compliance with our high standards for conduct. We perform routine audits to ensure their compliance to these standards. | | | | | Governance | ● | Our Board is committed to strong independent oversight, with a robust Lead Independent Director role. Other than our CEO, all of our directors are independent. | | ● | We have regular executive sessions of independent directors. | | ● | All independent directors have access to management. | | ● | Our Board committees have the authority to retain outside advisors. | | ● | We review the Board leadership structure annually and believe it best aligns the interests of MPS and our stockholders. |

| ● | We have a director voting policy that provides that any director nominee who receives more “Withheld” votes than “For” votes in an uncontested election held in an annual meeting of stockholders is required to promptly tender his or her resignation. | | ● | We have a clawback policy. | | ● | We have stock ownership guidelines for our NEOs and directors. | | ● | Our Code of Ethics and Business Conduct is consistent with the principles promoted by the Responsible Business Alliance emphasizing compliance, transparency, whistleblower protection and avoidance of any business practices that could contribute to corruption, bribery or conflicts of interest. | | ● | Our Code of Social Responsibility outlines standards to ensure safe working conditions, an environment of respect, fairness and dignity for all employees and responsible operations. | | ● | We promote Board diversity and are committed to appointing one female Board member before the end of 2021. | | ● | We are committed to stockholder engagement. In 2020, we engaged in discussions with the majority of our stockholders. |

2020 Highlights | Strengthening the Board’s Role |

An increasing focus of the Board is the oversight of our ongoing ESG efforts and their impact on our business, key stakeholders and communities. In 2020, our Board amended the Compensation Committee Charter and the Nominating Committee Charter to reflect their continued commitment to proactively guide our ESG compliance efforts and practices: Compensation Committee Charter | ● | Review and discuss with management our practices with respect to ESG matters. | Nominating Committee Charter | ● | Review and discuss with management our practices with respect to human capital management, including company culture, talent development, and diversity and inclusion programs and initiatives. |

On a periodic basis, the Board and each committee will provide oversight of management’s ESG compliance efforts by focusing primarily on the following areas: | ● | Assessing risks and opportunities and their impact on our operations; |

| ● | Setting measurable company goals, monitoring progress and reviewing status reports; |

| ● | Aligning executive compensation with rigorous performance goals tied to ESG initiatives and metrics; |

| ● | Evaluating management’s ongoing engagement and communications with our stockholders and other key stakeholders; and |

| ● | Ensuring ESG policies and practices align with our overall business strategies. |

| Increasing ESG-Related Disclosures |

As part of our commitment to transparent disclosures on our ESG efforts, we launched an ESG website under the Investors Relations page on our corporate website in 2020. The ESG website provides important information regarding our values, policies and practices in one centralized location. In addition, the website also highlights new initiatives that are relevant and important to our business, and significant progress we have made towards reaching those goals. We encourage you to visit and explore the website at https://www.monolithicpower.com/about-mps/investor-relations/esg-report.html. We also plan to provide our stockholders an annual update in our proxy statements of our ESG-related initiatives, progress, accomplishment and goals. | Giving Back and Supporting Our Communities |

We believe in being an active corporate citizen and making a positive impact on communities where we do business. To undertake our philanthropic duties, we launched the MPS Charitable Foundation, a 501(c)3 organization, in 2020. The mission of this philanthropic arm is to foster and increase the resources of local communities by supporting non-profit organizations that focus on areas such as education, arts, healthcare, food banks and youth programs with monetary contributions or investments. In 2020, we donated approximately $300,000 to organizations including Virginia Mason Hospital, Boys & Girls Clubs of Bellevue, Second Harvest Food Bank, and Palo Alto Medical Foundation. In addition, we pledged $500,000 to the MPS Charitable Foundation. | Combating COVID-19 Pandemic |

In 2020, as part of our efforts to help combat the pandemic and provide the needed resources to the medical community, our engineering team assembled an emergency ventilator inspired by the open-source MIT design to aid in the fight against the pandemic. We applied our expertise in power management and motor controls toward a solution that can safely and easily automate a manual resuscitator when a full ICU ventilator may not be available. Goals for 2021 and Beyond We believe diversity drives innovation and is key to our success. Currently, the Board consists of members with a wide variety of skills, industry experiences and backgrounds. We are committed to diversity and inclusion at every level of MPS, including the Board. Our Nominating Committee has been actively recruiting a female Board member, with the assistance of the full Board, our management team and a retained search firm. We believe a diverse, balanced and cohesive Board is critical in facilitating strong oversight, as well as supporting the achievement of MPS’s objectives, including its strategic priorities to improve long-term operational and financial performance and enhance stockholder interests. Our philosophy ensures each Board member’s individual interests are represented and their perspectives and opinions are valued. To accomplish this goal, the Board believes it is important to conduct in-person meetings (in addition to virtual meetings) in order to have the necessary interactions to evaluate the candidates, review their qualifications thoroughly, build trust and develop a strong relationship with existing Board members. This important process has been made more challenging by the COVID-19 pandemic, as the majority of candidates considered to date and many of our Board members are located in Asia and Europe where there are strict travel restrictions and shelter-in-place orders. We recognize the importance of moving the recruiting process forward and are taking practical steps to reach the final stage. The Board is fully committed to completing its search to appoint one female Board member before the end of 2021. | Commitment to Environmental Initiatives |

We take environmental stewardship seriously, and the Board recognizes the opportunities and importance of implementing measures to reduce our overall impact on the environment. In February 2021, as part of our commitment to promoting environmental sustainability, the Compensation Committee implemented changes to our executive equity compensation program to include long-term performance conditions with a three-year performance period that are tied directly to the following environmental metrics: | ● | Establish an environmental and climate change policy that identifies key areas for improvement with respect to environmental matters affecting our business. These objectives will primarily include hazardous material waste management, greenhouse gas emission, and energy consumption (collectively, the “Main Objectives”). |

| ● | Establish an environmental, health, safety and sustainability task force and completes an investigation of the existing baseline performance of the Main Objectives. |

| ● | Establish a long-term improvement plan, including setting specific targets for reduction, for each of the Main Objectives. |

The Compensation Committee believes that incorporating key environmental sustainability initiatives into our annual incentive equity awards for the NEOs will help drive our efforts in these important areas of focus for MPS. PROPOSAL TWO RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Change in Independent Registered Public Accounting Firm

OurThe Audit Committee completed a process to reviewof the appointment of our independent registered public accounting firm for the year ending December 31, 2019. As a result of this process, on March 18, 2019, our Audit Committee approved the appointment ofBoard has appointed Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the year ending December 31, 2019, and dismissed Deloitte2021. Ernst & Touche LLP (“Deloitte”), whoYoung has served as our independent registered public accounting firm since 1999, from that role.